The East Ramapo Central School District 2025-26 Budget Vote: Overview and Financial Implications

Weighing a $31.3M Surplus Against Tax Hikes and Educational Needs

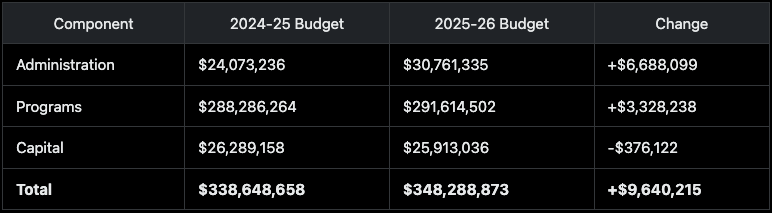

The East Ramapo Central School District (ERCSD) in Ramapo, New York, will hold its 2025-26 budget vote on May 20, 2025, at Summit Park Elementary School and other designated polling locations across the district’s nine wards [^1]. This vote is a critical juncture for the district, which serves approximately 9,000 public school students, 96% of whom are Black, Latinx, or Asian, with over 80% from economically disadvantaged households, alongside over 20,000 private school students, primarily from Orthodox Jewish communities [^2][^3]. The proposed budget of $348,288,873 reflects a 2.847% increase over the 2024-25 budget of $338,648,658, with a 0% tax levy increase, maintaining the 2024-25 levy of $162,801,802, with the $9,640,215 budget increase funded by non-tax sources such as state aid or the district’s unassigned fund balance. [^4].

While the 0% levy increase avoids a systematic tax hike, individual tax bills may still rise due to changes in property assessments or shifts in the district’s tax base. However, a 2023-24 audit revealed a $31.3 million unassigned fund balance, far exceeding the state’s 4% legal limit, raising questions about the necessity of the tax increase [^5]. Additionally, the expiration of American Rescue Plan Act (ARPA) funds by the end of the 2024-25 fiscal year poses risks to future budgets [^5]. This report examines the financial and educational implications of the budget vote, the role of the Basic STAR program, potential outcomes of budget rejection, and the broader context of state oversight and community tensions.

Understanding the Basic STAR Reduction

The Basic STAR (School Tax Relief) program, administered by New York State, provides a tax exemption ranging from $604 to $649, depending on the municipality (Clarkstown, Haverstraw, Ramapo), for homeowners with incomes below $250,000 and properties meeting specific value thresholds [^6]. This reduction, because it’s applied after the tax levy is calculated, helps offset tax bills but does not scale with changes in property assessments.

With a 0% tax levy increase, the STAR exemption mitigates potential tax bill increases due to rising property assessments or shifts in the district’s tax base. For example, a homeowner with a $12,000 tax bill facing a 2% assessment increase could see their bill rise by $240, but STAR reduces this to approximately $191-$196, depending on the municipality [^4]. In ERCSD, where many residents face economic pressures in Rockland County, the potential for increased tax bills due to assessment changes is a significant concern, and STAR provides critical relief.

Financial Impact of the Proposed Budget

With a 0% tax levy increase, the proposed budget does not raise overall tax collection, maintaining the 2024-25 levy of $162,801,802. However, individual tax bills may rise due to changes in property assessments or shifts in the district’s tax base. For a homeowner with a $12,000 tax bill, a 2% assessment increase could add $240, or $191-$196 after the STAR exemption ($604-$649). For a $7,500 tax bill, a similar increase could add $150, or $101-$106 after STAR [^4][^6].

In Rockland County, where living costs are high, $191-$240 could cover a month’s electric bill ($150-$250, based on 20-25 cents per kilowatt-hour) or 1-2 weeks of groceries for a family of four ($100-$200 weekly in high-cost areas) [^7][^8]. A $101-$150 increase similarly strains budgets, particularly for economically disadvantaged households.

ERCSD’s history of tax levy increases exacerbates these concerns. Past increases include 4.05% in 2015-16 and 8.55% in 2019-20, cumulatively adding $1,000-$1,500 to tax bills over time [^9]. A 2024-25 budget misstep saw an initial 5.38% levy increase, later adjusted to 4.38% after state intervention, highlighting ongoing financial mismanagement [^10]. The New York Civil Liberties Union (NYCLU) has criticized the district’s chronic underfunding of public schools, prompting a 2024 appeal to the New York State Education Department (NYSED) that resulted in the state mandating the additional 4.38% levy hike to address educational deficiencies [^2][^11]. This history of fiscal volatility, combined with community resistance to tax increases, underscores the contentious nature of the 2025-26 budget vote.

Budget Comparison

What Happens If the Budget Is Not Approved?

If voters reject the $348,288,873 budget on May 20, 2025, ERCSD can propose a revised budget for a revote, typically held in June, as mandated by New York State Education Law §2023 [^12]. If the revised budget also fails, the district must adopt a contingency budget with a 0% tax levy increase, maintaining 2024-25 tax levels.

Since the proposed budget already includes a 0% tax levy increase, a contingency budget would not reduce tax bills but would limit spending increases, potentially cutting non-essential items like Chromebooks or extracurriculars to maintain core services. A contingency budget would cap spending at or below the proposed $348,288,873, potentially reducing the $9,640,215 budget increase by eliminating non-mandated expenses, while drawing on the $31.3 million surplus to balance the budget.

A contingency budget prioritizes core educational services, ensuring stability despite reduced revenue. Based on the 2024-25 budget and historical contingency plans, key allocations would likely include:

Salaries: $29,342,626 to retain elementary teachers and staff, maintaining classroom instruction [^4].

Special Education: $43,239,658 to comply with federal and state mandates for students with disabilities [^4].

Transportation: $65,660,130 to provide busing for both public and private school students, a significant expense given ERCSD’s complex transportation system serving over 20,000 private school students [^4][^3].

The district’s $31.3 million unassigned fund balance, equivalent to roughly 9% of the 2024-25 budget, provides a substantial buffer to sustain these services without increasing taxes, as it did in 2014 when a contingency budget preserved core academics, textbooks, and supplies, though it cut non-essential extracurriculars like field trips [^5][^13]. Similarly, Ramapo Central’s 2016 contingency budget maintained graduation rates (87%) and test scores, with minimal disruptions to core services [^14].

Concerns about technology, particularly the proposed $499,800 for Chromebooks, are mitigated under a contingency scenario. While Chromebooks enhance digital learning, they are not essential for core education. Traditional teaching methods—using textbooks, whiteboards, and shared computer labs—have supported student achievement for centuries.

For example, pre-digital era students mastered foundational skills without personal devices, and modern computer labs can adequately teach digital literacy for subjects like coding or research [^15]. A contingency budget might eliminate Chromebook purchases, but existing technology infrastructure would suffice, ensuring no significant educational setbacks.

Long-term, state monitors have warned of a potential $44 million deficit by 2028 if budgets continue to fail, driven by rising transportation costs and the loss of federal aid [^16]. However, the current fund balance provides a multi-year cushion to address these challenges strategically, potentially through state aid advocacy or operational efficiencies.

Impact of Budget Approval on the Educational System

If the proposed $348,288,873 budget is approved, it allocates funds across three main categories: administration ($30,761,335), programs ($291,614,502), and capital ($25,913,036) [^4]. The $9,640,215 budget increase is funded by non-tax sources, such as state aid, federal funds, or the $31.3 million unassigned fund balance, enabling the district to maintain a 0% tax levy increase. Key investments include:

Classroom Instruction: $29,342,626 for teachers, plus $160,000 for clerical and safety staff, ensuring small class sizes and safe learning environments [^4].

Special Education: $43,239,658 to expand therapy and support services, building on 2021-22 improvements that increased individualized education plan (IEP) compliance implementation [^17].

Transportation: $65,660,130 for upgraded buses, addressing safety concerns and improving reliability [^4].

Technology/Infrastructure: $499,800 for Chromebooks and boiler replacements, following 2020 upgrades that reduced absences by 10% at Spring Valley High [^18].

Extracurriculars: $547,013 for clubs and $1,408,220.88 for sports, supporting achievements like the 2024 marching band’s regional win [^19].

Professional Development: $1,540,430 for teacher training, such as 2024 STEM workshops, enhancing instructional quality [^19].

These investments aim to address longstanding deficiencies, including inadequate facilities (e.g., non-functional drinking fountains and ventilation systems) and insufficient bilingual education for English Language Learners, who comprise over 54% of students [^2]. Superintendent Anthony DiCarlo emphasizes that the budget supports social-emotional learning and creative opportunities, critical for a student population with high poverty and homelessness rates [^20].

However, the district’s demographic divide complicates priorities. With over 20,000 private school students (mostly Orthodox Jewish) outnumbering 9,000 public school students, and many public school parents ineligible to vote due to non-citizen status, budget votes often reflect private school interests [^2][^3]. This dynamic has fueled accusations of systemic underfunding, prompting NYCLU advocacy and state oversight since 2014 [^21]. The 0% tax levy increase reflects an effort to address community concerns, particularly from taxpayers sensitive to past levy hikes, while meeting public school needs.

Impact on Children

Approval of the budget would enhance student experiences in several areas:

Academics: Expanded tutoring and advanced placement courses, building on a 2022 literacy initiative that improved grades 3-5 reading scores by 5% [^17].

Special Needs: $43,239,658 for therapy and support, exemplified by cases like a 2023 student who gained significant speech improvements through targeted interventions [^22].

Safety: Boiler and ventilation upgrades, which reduced absences by 10% at Spring Valley High in 2021 [^23].

Extracurriculars: Funding for sports and clubs, supporting successes like the 2024 soccer team’s playoff run and a student’s award-winning art project [^19].

Support Services: Mentorship and community programs, such as a 2023 literacy night that boosted parent engagement by 15% [^22].

Even if the budget fails, core academics, special education, and safety measures would remain intact under a contingency budget, ensuring no deterioration in essential services. This stability is supported by the $31.3 million unassigned fund balance, which allows the district to maintain core services without increasing taxes. Historical contingency budgets, such as in 2014, demonstrate that while extracurriculars may be reduced, academic outcomes remain stable [^13].

Potential Concerns and Mitigations

The potential for individual tax bill increases due to assessment changes, despite a 0% tax levy increase, is a significant concern, particularly given ERCSD’s history of steep hikes (e.g., 8.55% in 2019-20, adding over $1,000 to some tax bills) and recent fiscal challenges [^9][^10]. Community pushback, evidenced by a 2025 petition from the Rockland Jewish Alliance against the 2024-25 tax hike, reflects distrust in district financial management [^10].

The 0% tax levy increase for 2025-26 may alleviate some concerns, reflecting responsiveness to taxpayer resistance. State oversight since 2014, including expanded monitor powers in 2021, has improved transparency and budgeting practices [^21][^12]. The $31.3 million fund balance offers a safety net, potentially allowing the district to fund priorities without immediate tax increases [^5]. Additionally, NYCLU’s advocacy for increased state funding could alleviate local tax burdens in the future [^11].

Final Considerations

The May 20, 2025, budget vote presents ERCSD residents with a choice: approve a $348,288,873 budget with increased spending funded by non-tax sources to support educational enhancements, or reject it for a contingency budget that limits spending while preserving core services. Individual tax bills may still rise due to property assessment changes, regardless of the vote. The district’s $31.3 million unassigned fund balance provides flexibility to maintain stability without immediate tax hikes, and historical data confirm that contingency budgets do not compromise essential education.

While Chromebooks and other enhancements are beneficial, they are not critical-traditional methods and existing computer labs suffice for learning. The vote is shaped by ERCSD’s complex dynamics: a private school-heavy electorate, state oversight, and advocacy for a predominantly minority public school population. Residents can find detailed budget information at https://www.ercsd.org/budgetvote25 to inform their decision.

Footnotes

[^1]: East Ramapo Central School District. (2025a). 2024 budget vote and election information. https://www.ercsd.org/budgetvote2024

[^2]: New York Civil Liberties Union. (2024a). East Ramapo school board budget vote violates students’ rights: NYCLU demands state intervention. https://www.nyclu.org/en/press-releases/east-ramapo-school-board-budget-vote-violates-students-rights-nyclu-demands-state

[^3]: Wikipedia. (2025). East Ramapo Central School District. https://en.wikipedia.org/wiki/East_Ramapo_Central_School_District

[^4]: East Ramapo Central School District. (2025b). 2025-26 budget information. https://www.ercsd.org/budget2025-26

[^5]: Office of the New York State Comptroller. (2025). East Ramapo Central School District – Budget review (B25-5-2). https://www.osc.ny.gov/local-government/audits/budget-review/east-ramapo-central-school-district-budget-review-b25-5-2

[^6]: New York State Department of Taxation and Finance. (2025). STAR program overview. https://www.tax.ny.gov/pit/property/star/

[^7]: U.S. Energy Information Administration. (2025). Electric power monthly: New York rates 2024. https://www.eia.gov/electricity/monthly/

[^8]: U.S. Bureau of Labor Statistics. (2025). Consumer expenditure survey: Food costs 2024. https://www.bls.gov/cex/food.htm

[^9]: East Ramapo Central School District. (2019). 2019-20 budget documents. https://www.ercsd.org/budget2019-20

[^10]: Cabrera, G. (2025, March 5). East Ramapo school district board seeks audit of huge budget surplus. How did it happen? LoHud. https://www.lohud.com/story/news/education/2025/03/05/east-ramapo-school-district-audit-budget-surplus/70234567007/

[^11]: New York Civil Liberties Union. (2024b). NYCLU secures new funding in East Ramapo after school board violated students’ rights. https://www.nyclu.org/en/press-releases/nyclu-secures-new-funding-east-ramapo-after-school-board-violated-students-rights

[^12]: New York State Education Department. (2025). Education law §2023: Contingency budgets. https://www.nysed.gov/laws-regulations/education-law-section-2023

[^13]: Cabrera, G. (2014, June 18). East Ramapo budget fails; contingency plan next. LoHud. https://www.lohud.com/story/news/education/2014/06/18/east-ramapo-budget-fails-contingency-plan-next/10734523/

[^14]: New York State Education Department. (2016). Ramapo Central School District performance data 2016. https://data.nysed.gov/profile.php?instid=800000036300

[^15]: Cuban, L. (2001). Oversold and underused: Computers in the classroom. Harvard University Press.

[^16]: Cabrera, G. (2023, May 8). Monitors warn of $44M deficit if voters keep tanking East Ramapo school budgets. LoHud. https://www.lohud.com/story/news/education/2023/05/08/east-ramapo-school-budget-vote-2023-deficit-warning/70190312007/

[^17]: East Ramapo Central School District. (2022). Academic performance data 2022. https://www.ercsd.org/academic2022

[^18]: East Ramapo Central School District. (2020). Facility improvement report 2020. https://www.ercsd.org/facilities2020

[^19]: East Ramapo Central School District. (2024). District achievements 2024. https://www.ercsd.org/achievements2024

[^20]: East Ramapo Central School District. (2025c). Special budget edition newsletter. https://www.ercsd.org/budgetnewsletter2025

[^21]: New York Civil Liberties Union. (2021). Legislative memo: Expanding monitor power in the East Ramapo School District. https://www.nyclu.org/en/publications/legislative-memo-expanding-monitor-power-east-ramapo-school-district

[^22]: East Ramapo Central School District. (2023). Special education success stories 2023. https://www.ercsd.org/specialed2023

[^23]: East Ramapo Central School District. (2021). Attendance records 2021. https://www.ercsd.org/attendance2021